What is a Nonprofit Chart of Accounts? A Guide For Nonprofit Organizations

Understanding financial reports is crucial to the success of any business, for-profit or nonprofit. A well-organized and straightforward chart of accounts is a reliable foundation for financial reporting. Just as a strong foundation supports a sturdy building, an efficient chart of accounts ensures accurate and streamlined financial management. It provides the structure for reliable financial reporting and decision-making, preventing errors and confusion that could lead to instability.

Nonprofits depend on willing donors to fund their missions and goals. When a potential donor requests financial information, sending them reporting that is easy to read and glean information from is crucial to obtaining new funding and developing trust.

Creating a more straightforward chart of accounts can be overwhelming, especially if your list has more than three hundred items. An ideal chart of accounts has only a few hundred items and is grouped by their effect to your nonprofit. Each item falls under one of two umbrellas; the Statement of Financial Position, which holds your Assets, Liabilities, and Net Assets; and the Statement of Activity, which contains the Revenue and Expenses.

What is the Chart of Accounts (COA)?

A chart of accounts is a systematic way to organize and track financial transactions using different “accounts”. It provides a structure for organizing financial information, ensuring accurate allocation of transactions, and facilitating compliance with financial reporting standards.

A chart of accounts can provide your nonprofit with the information you need to make accurate and informed business decisions.

However, when creating a chart of accounts, there are common mistakes to avoid. One such mistake is using too many or too few accounts.

To customize your chart of accounts to fit your business needs, consider categorizing accounts based on their effect to your nonprofit and the specificity you need to make informed decisions.

Additionally, maintaining and updating your chart of accounts is crucial. Regularly review and adjust it to accommodate changes in expenses or income.

Utilize accounting software and tools to streamline the management process, saving time and ensuring accuracy.

Structure of the Chart of Accounts

The structure of your financial organization is like the backbone of your organization. It provides a framework that ensures accurate recording and analysis of your financial data.

One important aspect of this structure is the chart of accounts organization. When creating your chart of accounts, it is crucial to establish account categories that align with your business needs and industry standards. This will help you organize and categorize your financial information effectively.

Additionally, implementing an account numbering system can further enhance the organization of your chart of accounts. It is best to follow a standard numbering system that is easy for anyone viewing your chart of accounts to understand.

Lastly, following chart of accounts best practices, such as using clear and concise account names and maintaining consistency throughout the organization, will contribute to its effectiveness in generating meaningful financial reports.

How to Create An Effective Chart of Accounts

To create an effective chart of accounts, follow these steps:

Understand the purpose and importance of a chart of accounts:

A chart of accounts is a systematic way to organize and track financial transactions.

It provides a standardized framework for recording and classifying financial information.

It helps in generating accurate financial reports and analyzing the financial health of your nonprofit.

Determine the level of detail needed:

Consider the size and complexity of your organization when deciding how detailed your chart of accounts should be.

Smaller organizations may have a simpler chart with fewer accounts, while larger organizations may require more accounts to track various departments, locations, or revenue sources.

Identify the main account categories:

Start by identifying the main categories that will be the foundation of your chart of accounts.

Common categories include revenue, expenses, assets, liabilities, and equity.

These categories will serve as the highest-level accounts in your chart.

Create subcategories and sub-accounts:

Within each main category, create subcategories to further classify your transactions.

For example, under the expenses category, you may have subcategories like salaries, rent, utilities, and marketing expenses.

Each subcategory can have multiple sub-accounts to provide more detailed information.

Use numbering or coding system:

Assign a unique number or code to each account in your chart of accounts.

This numbering system helps in organizing and referencing accounts efficiently.

Consider using a logical numbering sequence that reflects the hierarchy and relationship between accounts.

Review and refine your chart of accounts:

Regularly review and refine your chart of accounts to ensure it remains relevant and meets your orgnization’’s needs.

As your organization evolves, you may need to add or remove accounts or make adjustments to the existing structure.

Statement of Activity Accounts

Revenue

Visual example of Revenue organization on the Statement of Activity

Any time a nonprofit organization receives income, it is considered Revenue.

It can be tempting to create a line item for every donor or every type of business that donates, but resist the temptation!

There only need to be four main types of Revenue listed on the Statement of Activity; Grant Revenue, Contribution Revenue, Fundraising Revenue, and Sponsorship Revenue. These four parent accounts allow revenue streams to be organized based on their relevance to the total Revenue, not the donor.

Each organization is different and will have different types of Revenue, including State Grants, Foundation donations, Raffle ticket sales, and much more. It is up to each organization to determine what categories to place items in to communicate a helpful report of the Revenue streams.

Expenses

Grant management is, at its core, the bookkeeping around expenses. Which donor funds pay for which expenditures? How should wages be expensed to grant funds?

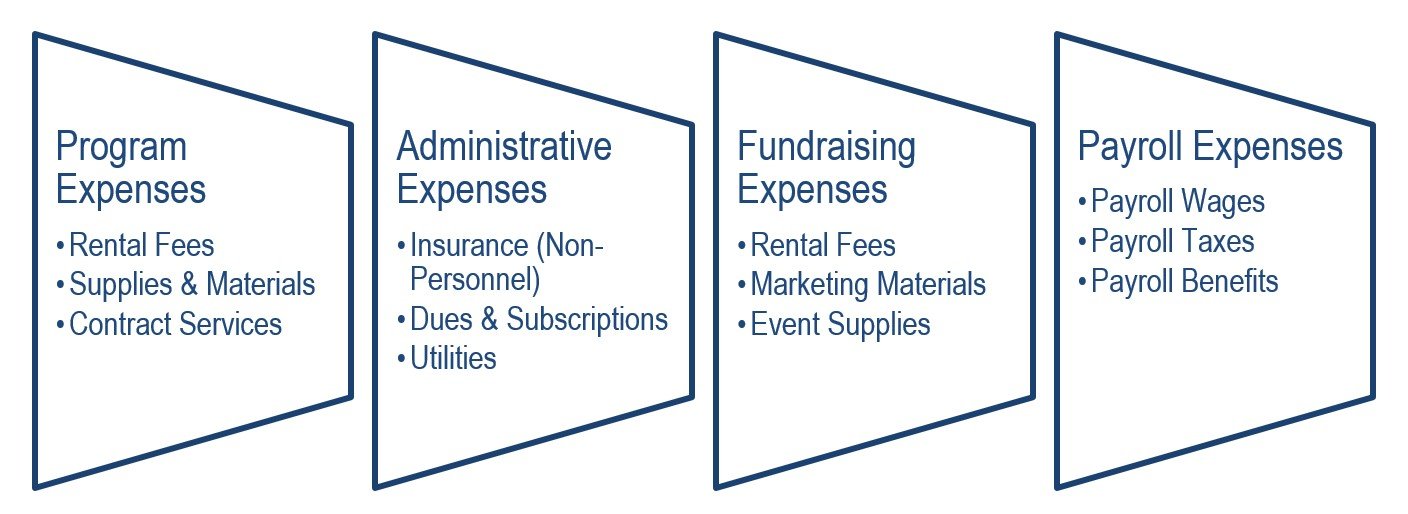

The key to successful and sustainable grant management is simplification. Like with Revenue, every nonprofit should use four primary parent accounts to categorize their expenses: Programs, Administrative, Fundraising, and Payroll.

Visual example of Expense organization on the Statement of Activity

There should not be separate accounts for printing, paper, paperclips, staples, postage, or envelopes. Office supplies will do just fine.

You can have repeating names of accounts to reflect the types of Expenses for each parent account.

For example, it is perfectly reasonable to have a Supplies & Materials account under Programs and another Supplies & Materials account under Administrative.

Statement of Financial Position Accounts

Assets

Visual example of category organization on the Statement of Financial Position

Luckily, the Assets portion of the Financial Position report is simple.

This section covers bank accounts, Accounts Receivable, Fixed Assets, and Inventory.

Simplifying the Assets section is about grouping accounts to be more visually digestible. Instead of listing each bank account as a parent account, creating a Bank Account parent account and listing each open account beneath it allows for simple reporting and a lack of confusion if there is more than one bank.

Also, organizations should ensure that each fixed-asset item has a contra account for depreciation.

Liabilities

Credit cards and tax liability accounts need just as much organizing in the Statement of Financial Position as Assets do.

This section only has four main liability categories: Accounts Payable, Credit Cards, Current Liabilities, and Long-Term Liabilities.

Like with Assets, having parent accounts for all the open credit cards will provide a better visual for any investor or board member.

If the Liabilities section is messy, it is safe to assume that the organization has debt that is also messy. Organizations can avoid that assumption by cleaning up their Liability accounts and grouping them to make the total Liabilities easier to identify.

Net Assets

Equity is the result of subtracting the total Liabilities from the Total Assets. The resulting net assets belong entirely to the organization, so it is essential to report these funds to help an organization make intelligent financial decisions quickly and confidently.

Nonprofits' equity is divided into Net Assets Without Donor Restrictions and Net Assets with Donor Restrictions.

Sometimes organizations track the status of funds, whether restricted or unrestricted, using other field methods in their accounting software. Reporting what net assets are limited and which are not, allows an organization to register flexibility in liquidating and fundraising.

How to use your chart of accounts

To maximize the potential of your financial information, follow these steps to effectively use your customized chart of accounts:

Track your organization’s cash: Use your chart of accounts to categorize and record all financial transactions accurately. This will help you keep track of your income, expenses, assets, and liabilities.

Understand what you owe: By organizing your accounts payable and accounts receivable in your chart of accounts, you can easily see what you owe to vendors and your unearned revenue. This will help you manage your cash flow effectively.

Monitor your spending: Use your chart of accounts to track your expenses and identify areas where you can reduce costs. This will help you make informed decisions about budgeting and cost-cutting measures.

Analyze profitability: With your chart of accounts, you can generate accurate financial reports that provide insights into the profitability of your organization. This will help you identify areas of strength and areas that need improvement.

Make informed decisions: By having organized and up-to-date financial information, you can make informed decisions about budgeting, resource allocation, and cost-cutting measures. This will help you optimize your organization’s financial performance.

Ensure compliance: A well-maintained chart of accounts is essential for complying with financial reporting standards and regulations. This will help you avoid penalties and ensure transparency in your financial statements.

Take advantage of your customized chart of accounts to unlock the full potential of your organization’s financial data. By following these steps, you can gain valuable insights into the financial health and performance of your business and make informed decisions to drive growth and success.

Importance of chart of accounts

The importance of a well-structured chart of accounts cannot be underestimated. It offers numerous benefits, including providing a clear overview of the company's financial areas, facilitating better decision-making, and ensuring compliance with financial reporting standards.

A well-designed chart of accounts allows for accurate allocation of transactions, making it easier to generate precise financial reports. However, there are common mistakes to avoid when creating a chart of accounts, such as using vague account names or failing to properly categorize accounts.

Customizing the chart of accounts to meet specific organization needs is essential for accurate recording and analysis. Technology plays a crucial role in managing and optimizing the chart of accounts by automating reference number generation and streamlining processes.

Regularly reviewing and updating the chart of accounts is considered best practice to ensure it remains relevant and aligned with evolving business requirements.

Need Help Setting Up?

Creating and adjusting the chart of accounts for any organization can feel overwhelming and scary. However, providing disorganized and over-complicated financial reports is much more frightening and overwhelming to those who must read and interpret them.

By simplifying the chart of accounts, all reporting becomes more effective and helpful to those who use them to make decisions about operations, payroll, budgeting, funding, and fundraising, to name a few choices every nonprofit faces daily.

Suppose the simplification process still feels too daunting. In that case, the team at Rachel Peterson Finance is available to help consult on the organizing process and transition into a more effective chart of accounts. Click here, or click the button below to schedule a free consultation with a nonprofit expert.